News | 12th September 2024

UK Tax and National Insurance Rates 2024 – 2025

Let’s talk about everyone’s favorite topic – TAXES!

Of course, this is only HMRC’s favorite topic, as they take some of your hard-earned cash. But the question on many people’s minds is: what changes are we expecting to see in the 2024-25 tax year and how will this affect our take-home salary?

Firstly, for those not familiar with the UK tax year end, it is a very strange 5th April! Hence, the tax year in the UK is split over two years.

Each Autumn, the UK government unveil their Autumn Statement where they also announce plans for the new fiscal year, including the proposed tax rates from HMRC.

So, what percentage of your hard-earned pennies are you going to have to fork over to the taxman this year?

Well, this very much depends on how much you make each year.

From 6 April 2024, the basic rate of income tax stands at 20% for earnings between £12,571 and £50,270. Anything earned up to £12,570 is tax-free (excluding any tax code adjustments). If you’re lucky enough to be raking in more than £50,270, you’ll be looking at a higher rate of 40% on earnings between £50,271 and £150,000. If you’re a high earner, brace yourself for the additional rate of 45% on anything over £150,000.

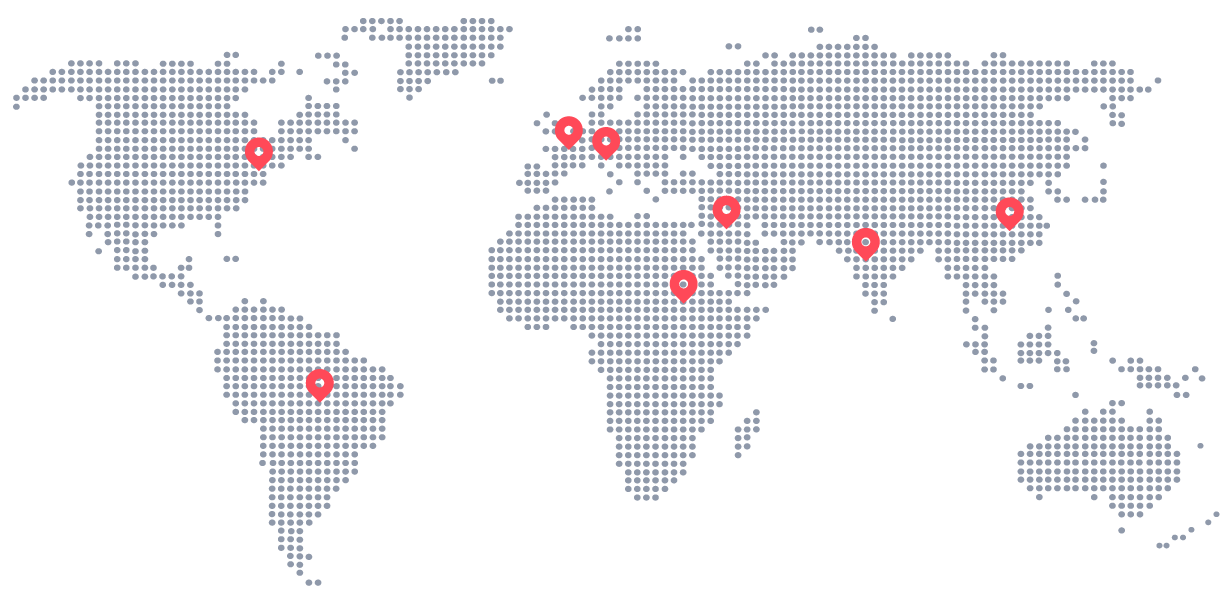

Get in touch

Our team of Employer of Record experts are ready to discuss your global expansion requirements. Fill out your details in the form provided and we will be in touch as soon as possible.