The terminology may also vary from country to country, with the term 13th month being adopted for payroll processing due to the nature of the payment being equal to an additional month’s salary. Similarly, the term ‘14th month‘ has been coined in countries where14 pay instalments are observed.

How is the 13th month pay processed?

It is imperative that the payment be processed through payroll and is subject to any applicable deductions. 13th month payments (or equivalent) may be tax exempt in some countries; therefore, it is essential to ensure the remuneration is processed correctly and itemised in payslips.

In countries where the bonus is regulated by law, the manner and timing of the payment should adhere to local legislation or applicable collective bargaining agreements. The contract of employment should stipulate the terms observed for any additional payment due to employees.

At the end of an employment relationship, employees will typically be entitled to a pro-rated amount of the 13th month (and 14th month) salary, and employers should budget for this accordingly.

How is the 13th month salary calculated?

The computation of the payment varies on a country-specific basis and may be included in the gross annual salary, as is observed in Italy, (total gross salary/14) or in addition to the base salary, akin to the practice in the Philippines and Switzerland, where the 13th-month payment is made as an additional payment equal to 1/12 of the base salary.

Some countries may also see the 13th month payment divided across two instalments, as is the case in Brazil and Greece.

It is, therefore, crucial to clearly communicate this arrangement to the employee through contractual documentation, specifying whether the total gross remuneration encompasses or excludes additional payments.

In some countries, employers have greater discretion in determining how and when the payment is made, as long as the employee receives all compensation due over the course of the year. For instance, in Spain and Portugal, employers can choose to divide the salary into either 12 or 14 equal instalments.

For employees who have not worked for the full year, the employer should award a pro-rated amount:

13th Month Pay Calculator

(Base monthly salary x number of months worked within the year) / 12

13th Month Pay: Country Guides

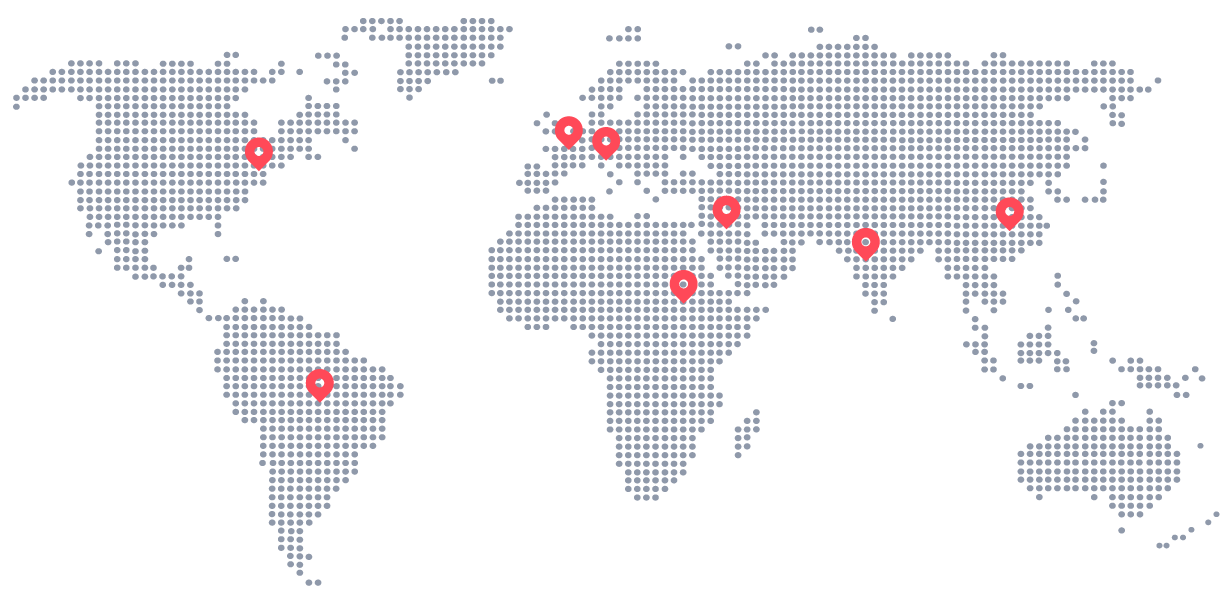

Listed below are some examples of countries which have adopted the payments. You can find further details in our downloadable Employment Guides surrounding the specifics of the payroll cycle and statutory regulations in each country.

Europe

The 13th (and even 14th month salary) is becoming more prevalent in European countries, with a number of collective bargaining agreements mandating the additional compensation as a form of financial support for employees.

Greece

13th month and 14th month pay are mandatory and are divided over three payments in Greece. The Christmas bonus, equal to one month’s salary, must be paid before 21st December; the second payment is divided in half, with one portion to be paid as the Easter Bonus (payable by Holy Wednesday) and the second half to be paid as a form of Leave Allowance to be paid by July each year.

Spain

13th and 14th month payments are commonplace under collective bargaining agreements in Spain. The salary may be divided into 12 equal instalments or 14, with the additional payments typically paid in July and December. The remuneration will be itemised on payslips as ‘pagas extras’ or ‘pagas extraordinarias.’

Portugal

The 13th and 14th month pay in Portugal are mandated under Articles 263-264 of the Portuguese Labour Code. The payments correspond to a form of mandatory holiday allowance (subsídio de férias) and Christmas bonus (subsídio de Natal).

Italy

All employees hired under the CCNL Terziario (NCA) in Italy, a 13th month (tredicesima) paid in December and 14th month (quattrodicesima) paid in June are mandatory.

Belgium

In Belgium, under the CBA – JIC 200 – salaries are calculated as 13.92 months: 13th month paid is in December + additional double holiday pay , equal to 92% of the gross monthly salary is paid in the summer.

Switzerland

13th month payment made in December to employees under respective CBAs in Switzerland.

Austria

It is customary under many sectors in Austria to to observe 14 payments. The two additional instalments are made in June and December.

Latin America

Many Latin American countries have implemented the ‘Christmas bonus’ or ‘aguinaldo’ as a mandatory compensation to its employees. There is a wide variation in the calculation of the payment across the continent which must be overserved.

Argentina

The SAC (Sueldo Anual Complementario) or Aguinaldo in Argentina is strictly regulated under the labor code (Law 27,073). The annual salary compensation is divided into two instalments: the first payment is due 30 June based on the salary earned in the 6-month period prior to the payment date. Employees are entitled to 50% of the highest salary earned during that period (inclusive of overtime, commission etc.).

Brazil

The 13º salário in Brazil is divided over two installments. The first must be made between 1st February and 30th November, with many employers awarding this to coincide with the summer vacation period. The second payment, referred to as the ‘Christmas bonus’ is paid by 20th December. The 13º salário should also include an average of any additional payments over the year (overtime, commission etc.).

Mexico

The aguinaldo is mandatory in Mexico and equal to at least 15 days’ pay. It is typically paid by 20th December each year.(N.B: this may be set to rise to 30 days)

Other Countries that award the ‘aguinaldo’ in Latin America include: Bolivia, Colombia, Costa Rica, Ecuador and Nicaragua.In Chile, the payment is customary in some industries.

Asia

Although Asia is the founding continent for the 13th month salary, the concept is only currently mandatory in two countries. That said, the payment is now customary in many Asian countries, often timed to coincide with religious festivals or the New Year.

Philippines

The founding nation of the 13th salary, the payment is due to any employee who has worked for a minimum of one month within a year. The payment should be equal to 1/12 of the employee’s base salary and must be paid by 24th December each year.

Indonesia

Referred to as the Tunjangan Hari Raya (THR) locally, this 13th month payment in Indonesia is a form of religious holiday bonus. It is mandatory for all full-time employees and must be paid at least one week before Eid-al Fitr.

Are you grappling with the complexities of international payroll compliance? Look no further than Agility EOR! Our team of experts is available to provide you with unrivalled support and guidance to navigate the intricate world of EOR and global payroll.

Why not download our detailed Employment Guides or arrange a consultation with one of our team to understand more about our services as an EOR provider.